The Iron Law of Climate Policy

When policies focused on economic growth confront policies focused on emissions reductions, it is economic growth that will win out every time

If there is an iron law of climate policy, it is that when policies focused on economic growth confront policies focused on emissions reductions, it is economic growth that will win out every time. That’s how I introduced the iron law in my book The Climate Fix back in 2010.

I coined the term to focus people’s attention on what might be called boundary conditions for the design of climate policies focused on reducing carbon dioxide emissions. Back then there was great enthusiasm for putting into place policies that would increase the costs of energy – the idea of “cap and trade” was all the rage. In The Climate Fix, I argued that accelerating decarbonization to hit climate targets by intentionally increasing energy prices was never going to work. It was not a popular view then, but it has become broadly accepted since.

One anecdote I cited at the time was the changing view of President Obama’s energy secretary, Steven Chu. Prior to taking a role in the Obama Administration, in 2008 Chu argued that addressing climate change required U.S. gasoline prices go to $9 or $10 a gallon. When testifying before the Senate in 2012, he was asked about this comment by Senator Mike Lee (R-UT), which he quickly disavowed.

“So are you saying you no longer share the view that we need to figure out how to boost gasoline prices in America?” Lee asked.

“I no longer share that view,” Chu replied.

“When I became secretary of Energy, I represented the U.S. government,” Chu added. “Of course we don’t want the price of gasoline to go up, we want it to go down.”

What caused Secretary Chu to reverse his view? The iron law.

The idea of using higher priced energy as a key tool to accelerate decarbonization makes perfect sense – in theory and in bloodless computer models. In the real world it runs up against the reality that while some people may be willing to pay higher prices of climate policy, that willingness is limited. Last fall, a University of Chicago opinion poll found that only 52% of Americans would be support (strongly and somewhat) to pay $1 per month to combat climate change., and 28% did not support even paying that much. As the proposed cost increases, support decreases. At $10 per month support and opposition were about equal in the poll.

As gasoline prices have recently spiked to over $5 per gallon nationwide, today the Biden Administration has quickly pivoted its stance on energy. Here are recent comments by President Biden and his Energy Secretary, Jennifer Granholm:

President Biden: “I led the world to coordinate the largest release of global oil reserves in history — 240 million barrels — to boost supply to keep prices from rising even more.”

Energy Secretary Granholm: “In this moment of crisis, we need more supply ... right now, we need oil and gas production to rise to meet current demand.”

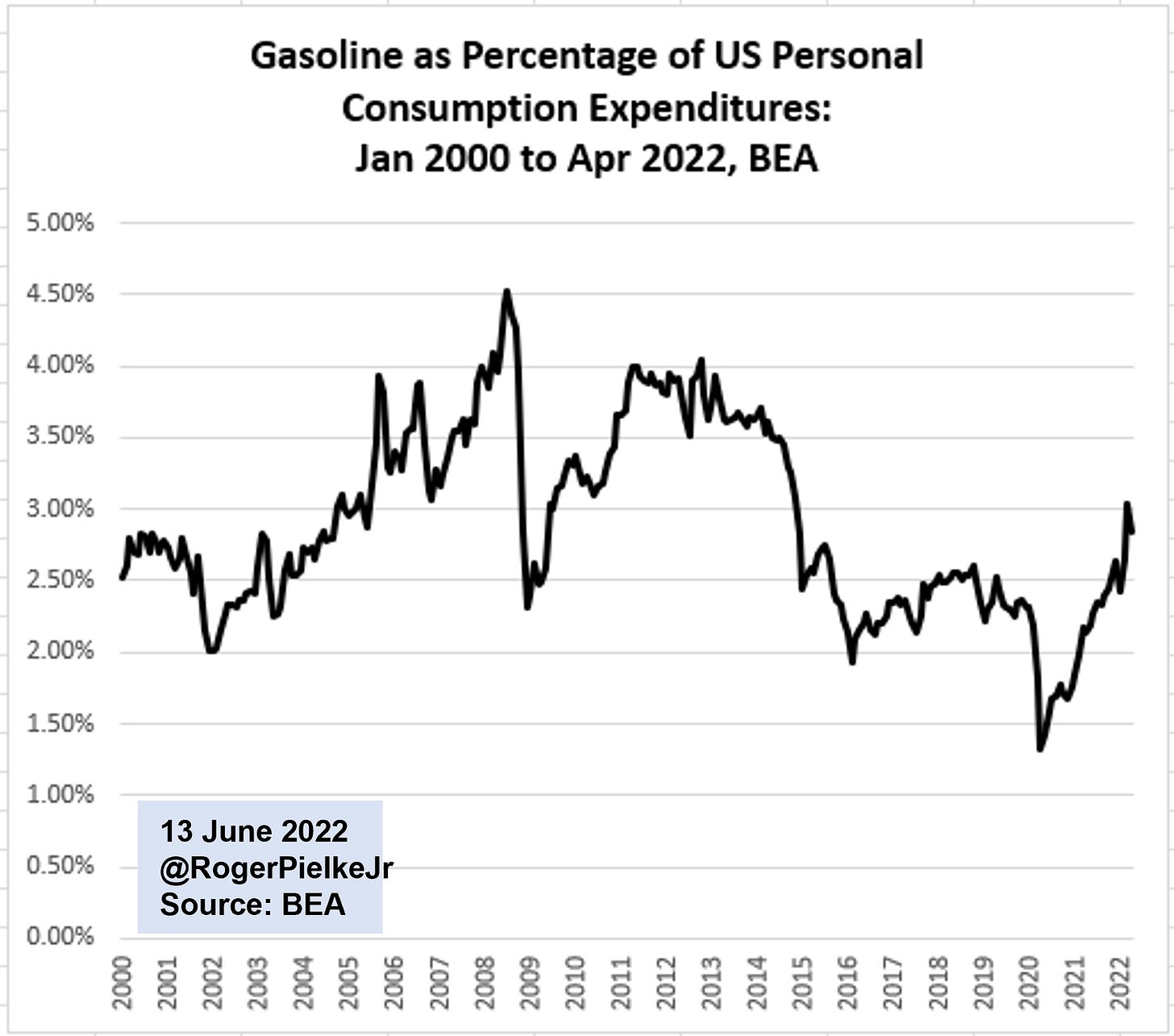

The figure below shows monthly gasoline spending as a percentage of overall U.S. “personal consumption expenditures” from January, 2000 through April, 2022.

At about 3% of spending in April, gasoline was at the highest level of overall spending since 2014. Since April, gasoline prices have increased by another 30%. All else equal, that would suggest that in June, 2022 gasoline would have increased to about 4% of personal consumption expenditures. That would mean that gasoline spending today takes up about three times the amount of spending in consumers’ budgets than it did in 2020, while the nation was in the depths of the pandemic. That is a big increase over a short time. No wonder President Biden’s attention is focused on energy prices and supply.

The dynamics described here are by no means unique to the United States. The iron law holds everywhere that people are found. When energy prices increase, for whatever reason, people respond. Consider these recent reactions to higher priced energy around the world:

Protests in Europe

Protests in Central Asia

Protests in Southeast Asia

Protests in South America

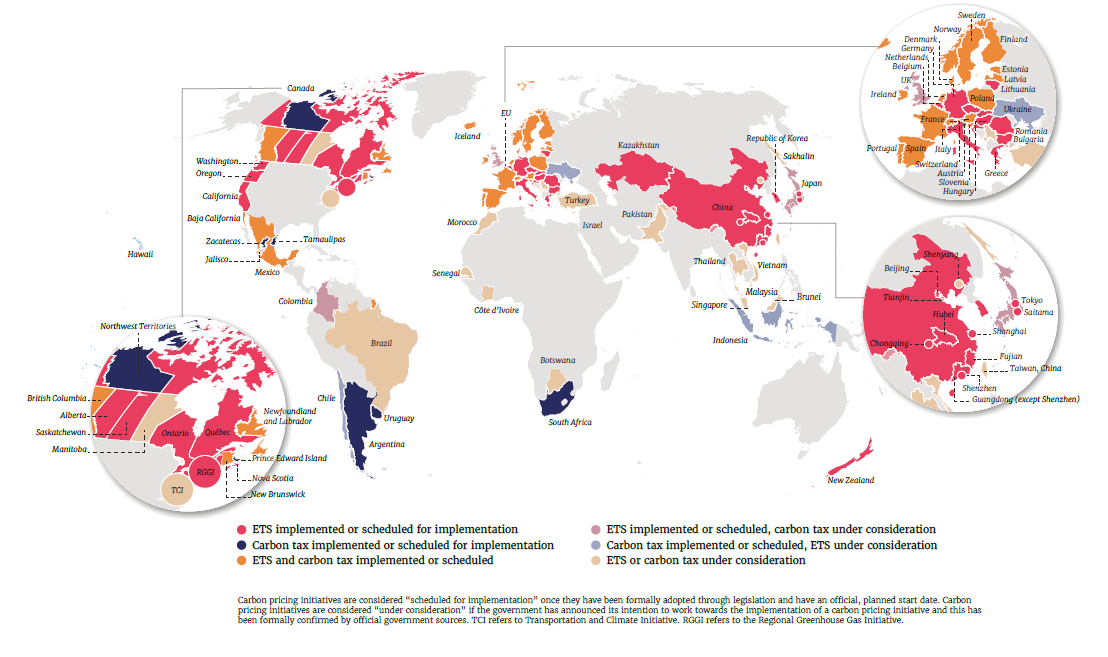

Carbon pricing does exist. The World Bank recently reported that there are more than 70 carbon-pricing instruments around the world, shown in the figure below. This is good news, as a carbon price will be a necessary element in policies focused on achieving deep decarbonization.

But such pricing must be consistent with the iron law. When we look at where carbon pricing is implemented we see what it means to implement carbon pricing consistent with the iron law. Here is what we have learned:

Richer jurisdictions more readily adopt carbon pricing

Carbon pricing is easier when existing energy supply relies less on carbon-intensive fuels

Carbon pricing requires keeping carbon prices sufficiently modest

These conditions are unlikely to change. As the World Bank observes, “adopting carbon prices remains politically challenging, particularly amid rising inflation and energy prices. There is a clear need to ensure policies are fair, effective, and embedded within integrated climate and social policies.”

I’ve long argued for a carbon price – not to influence consumers behavior – but to raise money to invest in accelerating a global energy transition. The World Bank reports that in 2021 carbon pricing instruments around the world raised more than $80 billion. That is not a lot of money in the context of either energy consumption or the global economy, which is a reflection of the reality of the iron law. But $80 billion is not nothing either. A low carbon price can raise funds to invest in clean energy innovation and deployment. A carbon price is also necessary to dodge the so-called green paradox associated with diminishing demand for fossil fuels. But those are topics for another day.

The iron law of climate policy is immutable. It means that substantially increasing the costs of energy, which supports every aspect of modern life, is off the table as a policy option for achieving deep decarbonization. That goes for formal pricing instruments as well as so-called “shadow” instruments such as efforts to limit supply of energy resources in hopes of driving up prices.

Once we relegate carbon pricing to a secondary role in climate policy, we are able to focus more clearly on the fact that accelerated decarbonization of the economy will occur through developing and deploying technologies of energy production and consumption that are both cleaner and cheaper (in terms of the prices people actually pay today). The iron law means developing policy that goes with the direction of prevailing winds, rather than against them. Its much easier to travel far when we do.

Paying subscribers to The Honest Broker receive subscriber-only posts, regular pointers to recommended readings, occasional direct emails with PDFs of my books and paywalled writings and the opportunity to participate in conversations on the site. I am also looking for additional ways to add value to those who see fit to support my work.

There are three subscription models:

1. The annual subscription: $80 annually

2. The standard monthly subscription: $8 monthly - which gives you a bit more flexibility.

3. Founders club: $500 annually, or another amount at your discretion - for those who have the ability or interest to support my work at a higher level.