This is a guest post by Benjamin Zycher, Senior Fellow (and colleague of mine) at the American Enterprise Institute. THB invites critique and contrasting perspectives. Today’s guest post offers a rejoinder to my recent post here at THB — Joe Biden is the "Drill, Baby, Drill" President. We invite you to take up the discussion and debate in the comments. I’ll see you there! — RP

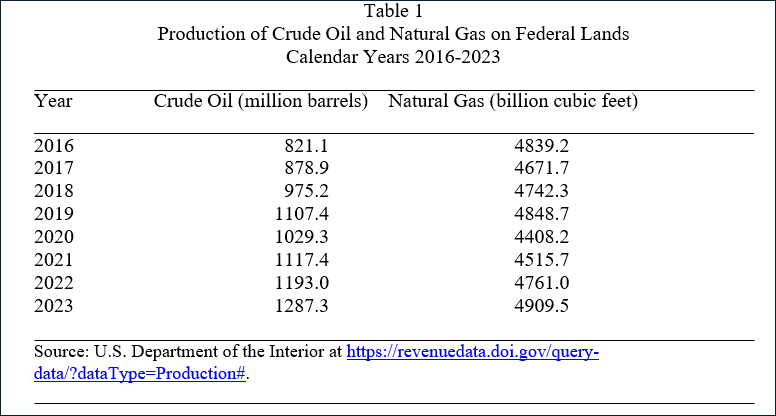

My AEI colleague Roger Pielke Jr. argues in a recent post that “Joe Biden Is the ‘Drill, Baby, Drill’ President,” by virtue of the time trend for U.S. oil production on federal lands (onshore and offshore) for 2008-2023.1 In summary, Pielke reproduces the data on oil production from federal lands as reported by the U.S. Department of the Interior, showing that such oil production increased by about 129 percent during 2008-2023, over 46 percent during 2017-2023,1 and by 25 percent in 2023 relative to 2020. Table 1 presents those production data for calendar years 2016-2023 for crude oil (and associated liquids) and natural gas.

Fossil energy production from federal lands is the end result of a lengthy process comprising complex preliminary analyses, leasing, exploration, permitting, and development, Pursuit of a lease on specific federal acreage is highly speculative, driven by some perceived potential for fossil production years in the future, under market conditions that are uncertain at best, and which may or may not yield an actual resource economically viable.

After a lease is obtained, geologic analyses — complex, time-consuming, and expensive — proceed, the central purpose of which is a determination of whether a drilling permit is worth pursuing. As a rough approximation, this process of geologic investigation consumes 2-4 years for onshore leases, and 7-8 years for offshore leases because of the enhanced attendant difficulties of engineering and logistical analyses.

Administrative, regulatory, and litigation challenges can lengthen the process, the end result of which might be a determination that a given lease on a given geological formation offers a resource sufficient in size and cost characteristics to be economically viable. Moreover, horizontal drilling requires leases and permits on contiguous parcels, an additional complication often forgotten in the public discussion of federal leasing policies for federal lands.

Accordingly, the mere observation that production on federal lands has increased sharply during the Biden administration period after 2020 provides less support for Pielke’s assertion than one might conclude at first glance. Table 2 presents for fiscal years 2016- 2023 data for federal lands on total leases and acreage, new leases and acreage, and number of drilling permits approved by fiscal year, all as of October 1, 2023.

As discussed above, the number of new drilling permits issued in a given year is driven heavily by leases approved in prior years, followed by the geologic and other analyses needed to determine if a drilling permit is worth pursuing. Accordingly, it is leasing activity in prior years that is the central driver of fossil energy production on federal lands during the current year. Analogously, it is leasing activity in the current and/or most recent years that will prove the central determinants of such fossil energy production in future years.2

The increase in fossil energy production on federal lands observed during the Biden administration clearly is the result in substantial part of strong leasing and leasing acreage activity in 2019-2020. Both fell dramatically during the 2021-2023 period. The central conclusions to be drawn are that Mr. Biden is not the “drill, baby, drill” president, and that fossil energy production on federal lands is likely to decline during the next two to four years.

We welcome your comments, critique, and discussion. Honest brokering is a group effort and requires dissent, debate, and discussion of different views, data, and arguments. Thanks for supporting THB! —RP

It is not clear whether Pielke is reproducing the data from the Department of the Interior for fiscal or calendar years, but the differences are unimportant.

Obviously, market conditions — prices, input costs, etc. — also drive production activity.

I agree 100% with Mr. Zycher. Having spent over 30 years with the USDOI in their offshore leasing and production branch I know first-hand how long it takes to go from planning to production. One thing that he leaves out is the costly and time-consuming delays brought about by a myriad of lawsuits from different groups all seeking to stop drilling at any cost. These suits are quite often frivolous but still take years in court before they are dismissed, dropped, or decided. The tactic of delay, delay, delay is employed quite expertly by the plethora of groups that want to stop leasing and development on Federal lands.

Thanks much Roger. Perhaps the well known saying should be "the devil is in the lack of details"? That you have chosen to publish information that both clarifies and corrects gives me even more faith in the other information you post, which is the reason I subscribe.