The ECB’s Climate Models are Out of Whack - Technical Details

I have an op-ed in the Financial Times today on fatally-flawed climate stress testing by central banks, here are some additional details

At the Financial Times I have an op-ed (online today, printed tomorrow) that begins like this:

The late Kenneth Arrow, who won the 1972 Nobel Prize in economics, once worked as a long range weather forecaster in the US military. When he realised that these weather forecasts were no more accurate than random guesses, Arrow conveyed the message to his superiors. “The commanding general is well aware that the forecasts are no good,” Arrow was told. “However, he needs them for planning purposes.”

Somewhat like Arrow’s commanding general, the European Central Bank is currently conducting an economy-wide climate stress test. This makes good sense because climate change is real and serious. The ECB test, which aims to assess “the exposure of euro area banks to future climate risks . . . under various climate scenarios”, is also ambitious and wide-ranging. As ECB vice-president Luis de Guindos wrote in March, it projects 30 years into the future and covers around 4m companies worldwide and 2,000 banks — “almost all monetary financial institutions in the euro area”.

Unfortunately, the scenarios the ECB are relying on are obsolete, calling into question the whole exercise. Although somewhat technical, come down the rabbit hole with me on this one because things soon get interesting.

And a deep rabbit hole it is.

Climate experts advising global financial institutions have recognized (unlike many) that the scenarios that underlie almost all scenario-based climate research are out of date. The Network for Greening the Financial System (NGFS) observes “the RCP scenarios were designed about 10 years ago and do not match well with recent emissions trends.” So the NGFS, a consortium of central banks and others representing more than half of global GDP, has develop a set of bespoke climate scenarios.

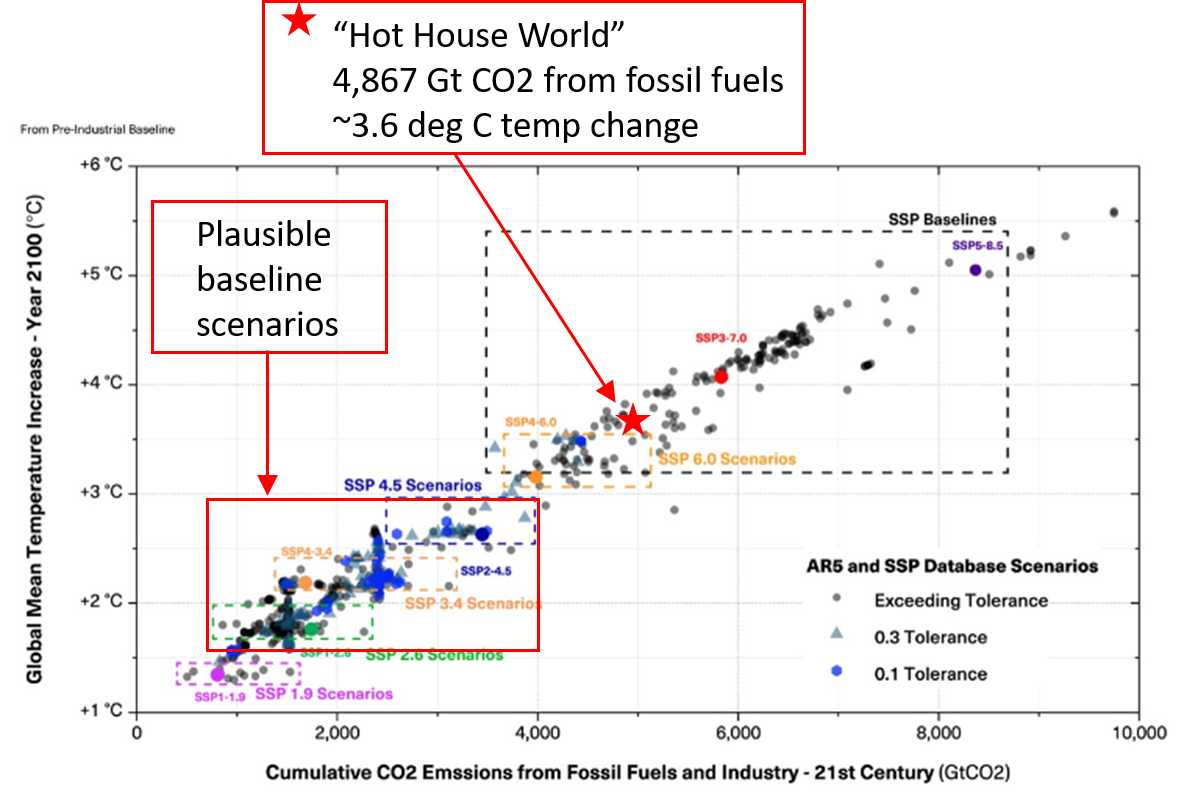

The NGFS uses three broad scenarios to guide climate assessments. “Orderly” assumes policy change starts now, leading to net-zero emissions by 2070. “Disorderly” assumes climate policies are delayed until 2030, requiring a quicker move to net-zero, by about 2050. “Hothouse world” assumes no change, with emissions growing to 2100 and severe environmental consequences.

"The “Hot House World” scenario is a baseline scenario — it serves as a reference to assess the consequences of taking different trajectories into the future. Such reference scenarios are intended to be hypothetical, extreme and plausible. “Hot House World” meets the first two of these criteria, but fails badly on the third.

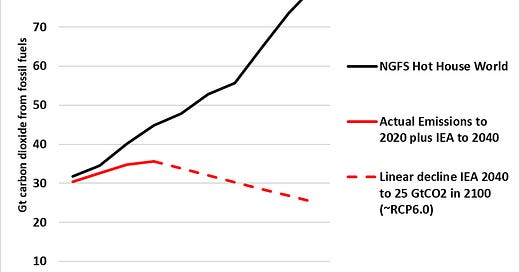

The figure at the top of this post illustrates the 21st century trajectory of carbon dioxide emissions from fossil fuels for “Hot House World” versus a simple scenario that tracks IEA projections to 2040 and then decreases linearly to 25 Gt of carbon dioxide in 2100 (roughly RCP6.0 in 2100). Rapidly growing emissions, which then accelerate late century, are simply an implausible expectation — they would require (for instance) a global commitment to covert most energy consumption to coal, and away from natural gas and renewables. That isn’t going to happen.

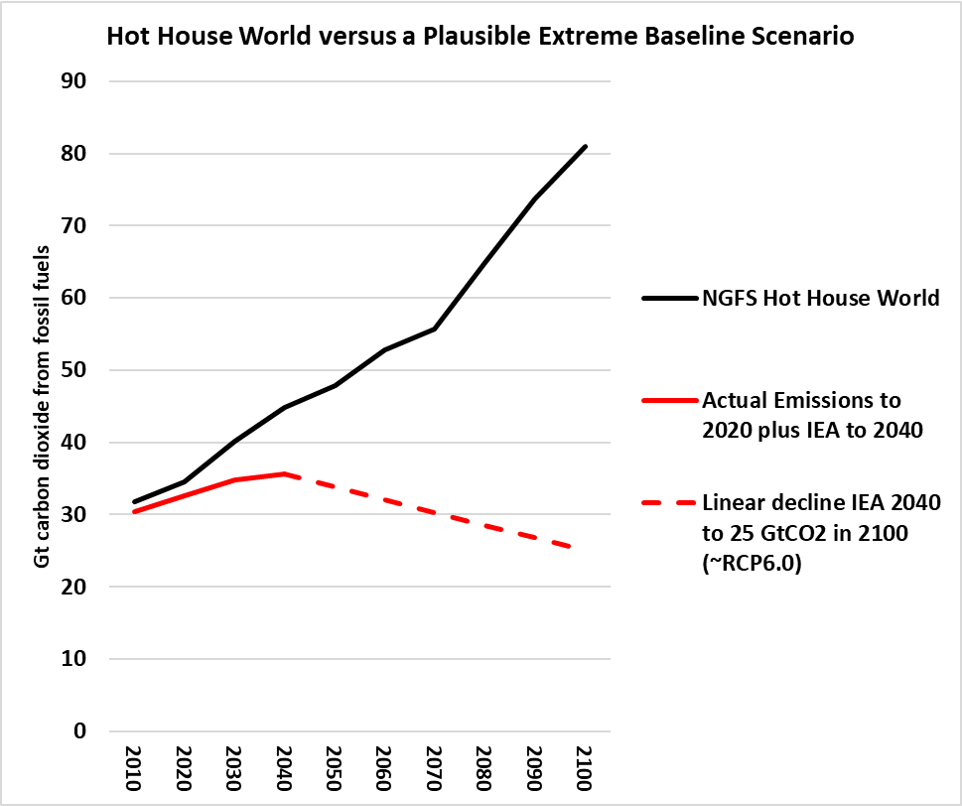

The figure below shows another perspective on the emissions of “Hot House World.” The figure shows cumulative emissions from fossil fuels 2020 to 2100 under “Hot House World” in red compared to three other simple scenarios.

“Net Zero 2050” assumes that the world achieves current ambitions to eliminate carbon dioxide emissions by mid-century — a big effort.

“Net Zero 2100” assumes that this goal is reached 50 years later.

“Constant 2020” assumes that emissions are not reduced below today’s levels for the next 80 years, remaining level.

You can see that the cumulative emissions of “Hot House World” vastly exceed each of these scenarios. While the world is presently not on track to achieve net-zero emissions by 2050, any progress toward that goal would render “Constant 2020” emissions implausible.

There is a worthwhile debate to be had on what level of emissions is both extreme and plausible, however there should be absolutely no debate on the utter implausibility of “Hot House World.”

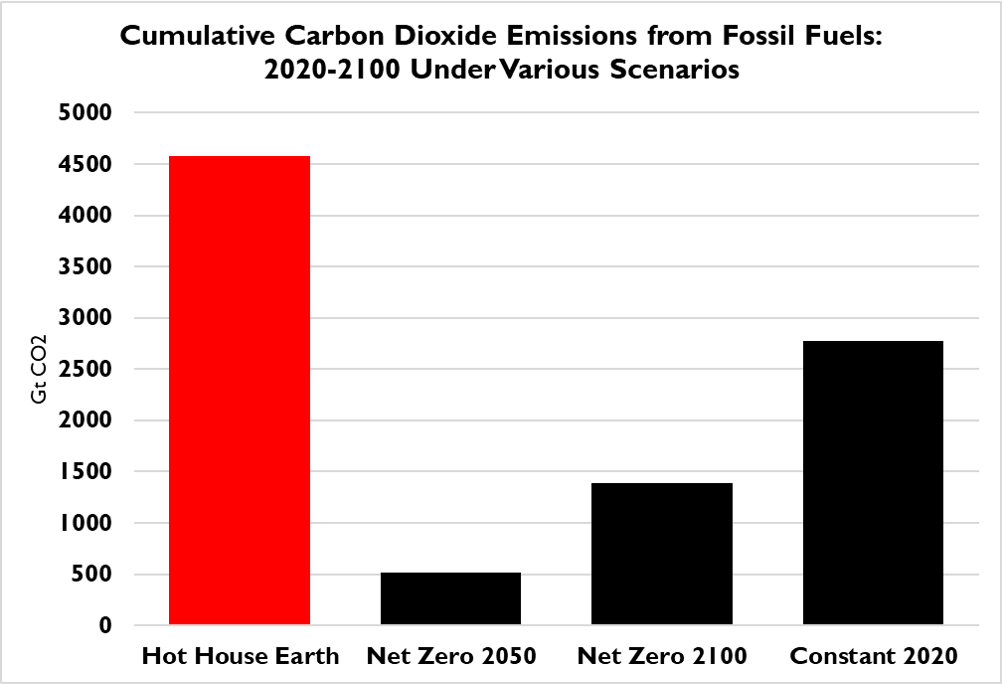

Finally, the figure below (from our latest paper on scenarios) places “Hot House World” into the broader context of existing climate scenarios. You can see that the NGFS has indeed made Hot House World” less extreme that the outdated baseline scenarios that guide most climate research (i.e., SSP7.0 and SSP8.5), but Hot House World” still remains an implausibly extreme scenario.

I conclude my op-ed by focusing on the ECB, however the issues with the use of outdated scenarios run much deeper in the global finance community.

The ECB uses its climate scenarios much as Arrow’s general used his “no good” weather forecasts — because there are no alternatives for planning purposes. Even so, there is an urgent need to take stock. Because these climate scenarios are typically out of sight and technical, those who rely on them may be unaware how they have diverged from the real world. Because they are institutionalised, changing these stress tests will also be hard.

Still, if financial institutions are to run meaningful climate stress tests, it is imperative that they be based on the latest science and not on improbable scenarios.